Finding a good loan can feel stressful, especially when you have to compare offers from many places. Traceloans.com makes this process simple by connecting you to lenders quickly and allowing you to see different options in one place. Whether you need a loan for personal use, your business, or something else, this website helps you make a smart choice without wasting time.

1. Introduction to Traceloans.com

Traceloans.com is an online platform designed for anyone looking to borrow money. Instead of visiting different banks or lenders, you can enter your details once and get matched with several offers. This saves time, reduces stress, and allows you to compare loans in a clear way. The goal of Traceloans.com is to make borrowing easier for both individuals and businesses by putting all the important information in one place.

2. What is Traceloans.com?

Think of Traceloans.com as a helpful bridge between you and lenders. You don’t have to do the hard work of contacting many banks, filling out forms again and again, or searching for the best deal on your own. With this site, you fill in your information once, and it sends your request to multiple lenders. You then receive offers to review, compare, and choose from based on your needs.

3. Types of Loans Available

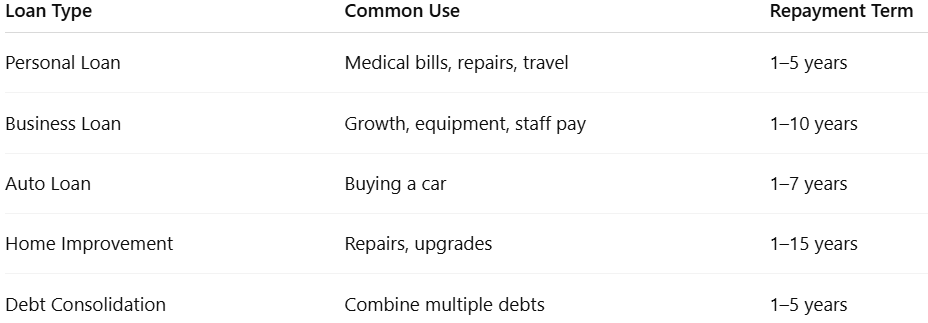

Traceloans.com offers a range of loan types to fit different needs. Personal loans are for individual use and can help cover medical bills, home repairs, education, or emergencies. They usually have short to medium repayment terms. Business loans are meant for companies, both small and large, to start new projects, buy equipment, or cover expenses like paying staff. They are useful for both start-ups and established businesses. Other loans available include auto loans for purchasing a car, home improvement loans for upgrading or repairing your home, and debt consolidation loans that combine several debts into a single, manageable payment.

4. How Traceloans.com Helps Borrowers

This platform makes the loan process easier by saving you time and giving you access to many offers in one place. Instead of searching lender by lender, you can compare interest rates, repayment terms, and benefits side by side. This helps you pick the right loan with confidence. The process is quick, user-friendly, and designed so that even first-time borrowers can navigate it easily.

5. Loan Application Process

Applying for a loan on Traceloans.com is simple. First, you visit the website and fill in your personal and loan details. You may need to upload certain documents like proof of income or identification. After submitting your application, the site will match you with multiple lenders. You can then compare their offers, select the one that works best for you, and complete the process directly with the chosen lender. The whole process is straightforward and can be done from home.

6. Factors Affecting Loan Approval

Several factors can affect whether your loan is approved. One of the most important is your credit score, which shows your borrowing history and repayment habits. Lenders also look at your income level and whether it is stable enough to make repayments. Your past repayment history and the total amount you request can also make a difference. Knowing these factors in advance can help you improve your chances of approval.

7. Benefits of Using Traceloans.com

There are many reasons why people choose Traceloans.com. It saves you time by collecting offers in one place. It is easy to use, even for those who are not tech-savvy. The site gives transparent loan details, so you know the terms before making a choice. It also increases your chances of approval by connecting you with several lenders at once, rather than relying on a single option.

8. Tips for Getting the Best Loan

Before applying for a loan, check your credit score to make sure it is in good shape. Borrow only what you can comfortably pay back, as this will keep your finances healthy. Compare interest rates from different lenders so you get the best deal possible. Finally, always read the terms and conditions carefully before signing any agreement to avoid surprises later.

Loan Types and Their Common Uses

9. Conclusion

Traceloans.com is a smart, simple, and time-saving way to find the right loan. It gives you multiple choices, clear comparisons, and the chance to choose what suits you best. Always remember to borrow responsibly and understand the loan terms before making a decision. If you are ready to explore loan options, you can visit Traceloans.com today and see what offers are available for you.