Introduction

Investing in stocks is one of the best ways to grow your money. Today, many people use 5starsstocks.com to help them choose the right stocks. It’s simple, beginner-friendly, and doesn’t need expert skills. You can start with small money and still get good results. That’s why more people are turning to this kind of smart investing.

Stock investment matters because it can give better returns than saving. While bank savings grow slowly, good stocks can grow faster. It’s a smart choice for people who want their money to work for them. Even if you’re new, it’s worth learning how stocks work.

This guide will walk you through everything step by step. You’ll learn how to use 5StarsStocks to find strong stock options. Don’t worry—we’ll keep it clear and easy. No big words or hard ideas. Just real, helpful tips for smart investing.

Understanding Stock Market Basics

Learning how the stock market works may sound hard, but it’s easier than you think. This section explains what stocks are, how the market works, and key terms that every beginner should know.

What Are Stocks and Shares?

Stocks are small parts of a company. When you buy a stock, you own a piece of that company. These pieces are called shares. If the company grows and makes money, your shares usually become more valuable. But if the company does poorly, the share value can drop. Owning stocks means sharing in both the profits and risks of the company.

Many people invest in stocks to grow their money over time. You don’t need a lot of cash to begin. Even one or two shares can be a good start. Stocks are popular because they offer higher returns compared to savings accounts.

How the Stock Market Works

The stock market is a place where people buy and sell shares. It works like a big online shop, but instead of items, you trade company shares. Buyers place an offer, and if a seller agrees, the trade happens instantly. These trades are made on stock exchanges, like the New York Stock Exchange or Nasdaq.

Stock prices go up and down every day. They change based on company news, world events, or how investors feel. If people think a company will do well, more buyers jump in, and prices go up. If there’s bad news, people may sell, and the price drops. It’s a cycle of demand and supply.

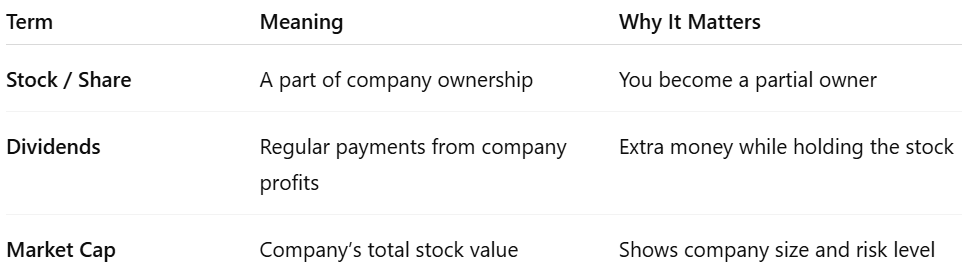

Important Terms to Know

As a beginner, there are a few simple words you should understand. One is dividends. These are payments a company gives to its shareholders, usually from its profits. Not all companies give dividends, but many stable ones do. It’s a way to earn money while holding a stock.

Another key term is market capitalization, or market cap for short. This tells you how big a company is. It’s calculated by multiplying the price of a single stock by the number of shares available. Companies are usually grouped as small-cap, mid-cap, or large-cap. Large-cap firms are usually safer, while small-cap firms can grow fast but carry more risk.

Here’s a quick summary of these terms for easy reference:

Criteria for Selecting the Best Stocks

Finding the best stocks to buy takes more than luck. You need to understand how a company is doing, what the numbers mean, and how the market feels. These simple tools and ideas can help you choose stocks that are strong, stable, and full of potential.

Fundamental Analysis

Fundamental analysis helps you look deep into a company’s health. It means checking the company’s business, its profits, and how it’s managed. If the company is making money and growing over time, that’s a good sign. You want to invest in companies that are doing well, not just looking good on the surface.

Earnings Reports

Earnings reports are released every three months. They tell you how much money a company made or lost. If earnings are going up, investors get excited. If they drop, the stock might fall. By reading earnings reports, you can spot strong companies before everyone else does.

Revenue Growth

Revenue is the money a company earns from selling its products or services. If this number is growing, that means the company is expanding. A steady rise in revenue usually leads to higher profits. This can make the stock price go up over time. Strong revenue growth often shows that the company has a bright future.

Price-to-Earnings (P/E) Ratio

The P/E ratio helps you understand if a stock’s price is fair. It compares the price of a stock to how much the company earns. A low P/E ratio can mean the stock is cheap. A very high one could mean the stock is overvalued. This ratio makes it easier to compare different companies side by side.

Technical Analysis

While fundamental analysis looks at the company itself, technical analysis looks at how the stock moves. It focuses on charts and past prices. Traders use it to find good times to buy or sell. It’s not about the company’s story but about how people are trading the stock.

Chart Patterns

When you look at a stock chart, you might notice shapes and patterns. These patterns often repeat. Some tell you the stock might go higher. Others warn of a possible drop. Simple shapes like triangles or flags help traders guess what’s next. It’s like reading a map for stock movements.

Volume Analysis

Volume tells you how many shares are being traded. When a stock rises with high volume, it shows strong interest. It means many people believe in the stock. If volume is low, it could mean weak support or lack of trust. Watching volume helps you understand how strong a price move really is.

Market Trends and Economic Indicators

Stocks don’t move alone. The whole market and global economy can push stocks up or down. News about jobs, inflation, or interest rates affects stock prices. For example, if the economy is strong, more people invest. If there’s bad news, they pull out. Following market trends helps you stay ready for big changes.

Top 5 Stocks to Buy Now

Choosing strong stocks can help you grow your money over time. Some companies stand out because they show steady growth, strong earnings, and trusted business models. Here are five stocks that are doing well right now and could be great options to buy.

Stock 1: Apple Inc. (AAPL)

Apple is one of the biggest tech companies in the world. It sells iPhones, iPads, and other devices people love. The company keeps making new products and earns billions every year. Its revenue continues to grow, and it pays steady dividends. Apple’s strong brand and loyal customers make it a safe pick. If you want a stock with long-term potential, Apple is a solid choice.

Stock 2: Microsoft Corporation (MSFT)

Microsoft is another strong tech company with great earnings. It owns Windows, Office, and cloud services like Azure. Microsoft’s business has grown quickly, especially in cloud computing. It also gives dividends to its shareholders. With stable profits and strong leadership, Microsoft is a reliable stock for the future. It’s a great pick for both new and experienced investors.

Stock 3: Amazon.com Inc. (AMZN)

Amazon is the world’s largest online shopping company. People all over the world use it every day. It also makes money through its cloud platform, AWS. Amazon is growing fast, even in tough times. Its revenue keeps rising, and more people are shopping online. This stock may not give dividends now, but its growth potential is huge. It’s great for investors looking for long-term gains.

Stock 4: NVIDIA Corporation (NVDA)

NVIDIA is known for making powerful computer chips and graphics cards. These chips are used in gaming, AI, and self-driving cars. The company’s stock has gone up fast in recent years. Demand for AI and graphics is rising, and NVIDIA is leading the way. With strong profits and growing markets, this stock is worth watching. It’s a good pick for tech-focused investors.

Stock 5: Johnson & Johnson (JNJ)

Johnson & Johnson is a trusted name in healthcare. It makes medicines, medical tools, and personal care items. This company has been around for a long time and is known for steady growth. It also pays good dividends, which is great for income. Even when the market drops, healthcare stocks like J&J stay strong. It’s a smart pick for safety and steady returns.

Investment Strategies

Smart investing is not just about picking good stocks. It’s also about how you invest. The right strategy can help you avoid big losses and grow your money over time.

Long-Term vs. Short-Term Investing

Long-term investing means holding stocks for years. It’s slower, but usually safer. You ride out the ups and downs. Short-term investing is faster. You buy and sell often to make quick profits. It can bring fast gains, but also more risk. Choose the one that fits your goals.

Diversification of Portfolio

Don’t put all your money into one stock. That’s risky. Diversification means spreading your money across different companies and industries. If one stock drops, others can protect your money. A balanced portfolio is a smart way to reduce loss and increase stability.

Risk Management Techniques

Every investment has some risk. But you can manage it. Set a budget. Don’t invest more than you can afford to lose. Use stop-loss orders to protect yourself from big drops. And always do your research before buying any stock. These small steps help you stay safe and in control.

Conclusion

Investing in stocks can help you grow your money. But smart investing starts with good information. When you learn how to pick the right stocks, you reduce your risks and boost your chances of success.

Keep learning. Stay updated with news, trends, and earnings reports. The more you know, the better choices you make.

Don’t rush. Take time to study before you invest. Use tools like 5starsstocks .com to guide your decisions. Start small, stay consistent, and always aim for long-term growth.

FAQs

1. Is stock investing safe for beginners?

Yes, if you invest wisely. Start small and choose strong, stable companies.

2. How much money do I need to start?

You can begin with a small amount—even $50 to $100. Some platforms allow fractional shares.

3. Should I invest for the short term or long term?

Long-term investing is safer and better for steady growth. Short-term trading carries more risk.

4. What’s the best tip for a new investor?

Do your research. Don’t follow hype. Diversify your portfolio to stay protected.

5. How can I keep learning?

Read news, watch the market, and use trusted platforms like 5starsstocks .com for updates and tips.

4 thoughts on “5StarsStocks.com: Your Ultimate Guide to the Best Stocks to Buy Now”